Bad Credit? Your Homeownership Dreams Can Still Become Reality

Homeownership is a dream shared by many individuals, but the presence of bad credit can often create the perception that it is out of reach. However, it is crucial to recognize that having a less-than-perfect credit score does not automatically signify the end of your homeownership aspirations. In fact, numerous alternative routes can be explored to achieve this significant milestone.

This comprehensive blog post aims to guide you through the various strategies and options available to individuals with less-than-ideal credit scores. By delving into the intricacies of credit repair, exploring alternative financing options, and providing valuable insights into the housing market, this post will equip you with the knowledge and tools necessary to navigate the path towards homeownership.

Embarking on this journey may seem daunting at first, but with the right information and guidance, you can overcome the challenges associated with bad credit and move closer to turning your homeownership dream into a reality. So, don’t let a less-than-perfect credit score hinder your aspirations. Explore the wealth of possibilities and empower yourself to make informed decisions as you embark on this transformative journey toward homeownership.

Understanding Credit and Homeownership

Bad credit is generally characterized by a credit score that falls below 600. Having bad credit can present challenges when it comes to securing a mortgage, as lenders may perceive you as a riskier borrower. Your credit score plays a crucial role in the home buying process, influencing various aspects such as mortgage approval and the interest rates you’ll be offered.

A low credit score can result from various factors, including missed or late payments, high credit utilization, or even a history of bankruptcy or foreclosure. It’s important to understand that bad credit is not a permanent situation, and steps can be taken to improve your creditworthiness over time.

Improving your credit score involves a combination of responsible financial habits, such as making payments on time, reducing debt, and keeping credit utilization low. By demonstrating a consistent track record of responsible credit management, you can gradually rebuild your credit and increase your chances of securing a mortgage with more favorable terms.

When applying for a mortgage with bad credit, it’s important to be prepared for potential challenges. Lenders may require a larger down payment, higher interest rates, or additional documentation to mitigate the perceived risk. Working with a financial advisor or mortgage specialist can provide valuable guidance and help you navigate the process more effectively.

Remember, while bad credit may present obstacles, it is not an insurmountable barrier to homeownership. With patience, diligence, and a strategic approach, you can improve your credit standing and fulfill your dream of owning a home.

Navigating Homeownership with Bad Credit

Contrary to popular belief, there are several viable options available for potential homeowners with bad credit who are seeking to secure a mortgage. These options cater to individuals with lower credit scores and provide opportunities to fulfill the dream of homeownership. Let’s explore some of these options in more detail:

- FHA Loans: These government-backed loans are designed to assist individuals with lower credit scores in obtaining a mortgage. FHA loans offer competitive interest rates and require smaller down payments compared to conventional loans. This can make homeownership more accessible for those with less-than-ideal credit histories.

- Unconventional Mortgage Loans: Another option for potential homeowners with bad credit is to consider unconventional mortgage loans. These types of loans include adjustable-rate mortgages or interest-only mortgages. While these options may carry more risk, they can be suitable for those who are confident in their ability to manage their mortgage payments effectively. It’s important to carefully evaluate the terms and conditions of these loans before making a decision.

- Bad Credit Mortgage Loans with Guaranteed Approval: Some lenders specialize in working with individuals who have poor credit and offer mortgage loans with guaranteed approval. These lenders understand that credit scores do not define a person’s ability to repay a loan and provide opportunities for those who may have been turned away by traditional lenders. However, it’s crucial to carefully review the terms and conditions of these loans, as they may come with higher interest rates or other fees.

While each of these options has its own set of pros and cons, the best choice for you will depend on your circumstances. It’s important to consult with a mortgage professional who can provide personalized advice and guide you through the process of finding the most suitable mortgage option for your needs.

Remember, having bad credit does not mean that homeownership is out of reach. By exploring these options and working with the right professionals, you can take steps towards achieving your goal of becoming a homeowner.

Improving Your Credit Score for Future Homeownership

Improving your credit score isn’t an overnight process, but with patience and discipline, you can boost your score over time. Several factors influence your credit score, including:

- Payment history: Pay your bills on time to avoid negative impacts on your credit

- Credit utilization ratio: Reduce your debt and keep your credit utilization low to improve your score.

- Length of credit history: Don’t close old credit cards as the length of your credit history affects your score.

- Credit mix: Maintain a healthy mix of credit types, such as credit cards, loans, and

- New credit applications: Limit the number of new credit applications to avoid potential negative impacts on your score.

Here are some tips to help you improve your credit score:

- Pay your bills on time: Set up reminders or automatic payments to ensure timely

- Reduce your debt: Develop a payment plan and consider consolidating debt if

- Keep old credit accounts open: This helps maintain a longer credit history and improves your credit score.

- Monitor your credit report: Regularly review your credit report for errors and dispute any inaccuracies.

- Seek professional advice: Working with a knowledgeable mortgage lender or credit counselor can provide personalized advice and strategies to improve your credit situation.

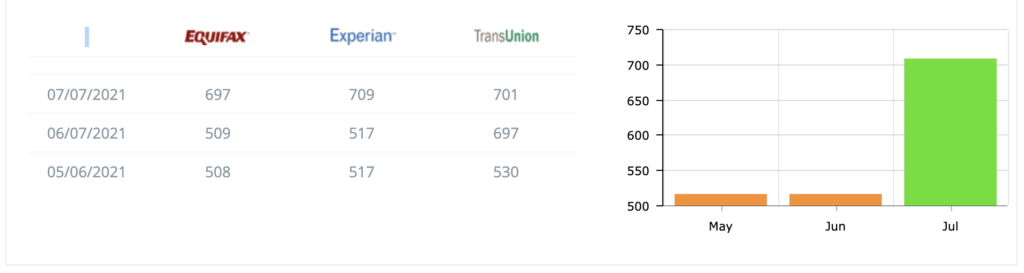

Remember, improving your credit score takes time, but by implementing these tips, you can make positive progress toward a better credit standing. If you would rather have professional help with credit repair, I highly recommend Extra Credit. While results do vary, check out the results they got from one of my clients.

Real-life Success Stories

There are numerous inspiring success stories of individuals who have navigated the challenging path of homeownership despite facing bad credit. These resilient individuals have triumphed over significant financial hurdles and have successfully secured a mortgage, demonstrating that a less-than-perfect credit score should not deter you from pursuing your dreams of homeownership.

These stories of perseverance highlight the importance of taking proactive steps to improve your financial situation and explore alternative options available to aspiring homeowners. From diligently working to repair credit, and seeking assistance from specialized lenders, to exploring government-backed programs, there is a multitude of strategies to overcome the obstacles associated with bad credit and achieve the goal of owning a home.

By sharing these stories, we can empower and inspire individuals facing similar challenges, reminding them that their dreams of homeownership are within reach. With determination, resilience, and informed decision-making, it is possible to overcome the barriers posed by bad credit and embark on the exciting journey of owning a home.

While some people tackle credit repair on their own, some prefer professional assistance with repairing their credit scores. If you prefer help, I highly recommend Extra Credit. While results do vary, check out the results they got from one of my clients.

Conclusion

Having bad credit can indeed present challenges on the road to homeownership, but rest assured, it’s not an insurmountable obstacle. There are various strategies and options available to help you achieve your dream of owning a home, even with less-than-perfect credit.

One potential avenue is exploring specialized loans designed for individuals with lower credit scores. These loans often have more flexible requirements and can provide an opportunity for those with bad credit to secure financing for a home purchase. Additionally, working diligently to improve your credit score can open up doors to more favorable loan terms and interest rates.

To improve your credit score, start by reviewing your credit report to identify any errors or inaccuracies that may be negatively impacting your score. Disputing incorrect information and paying off outstanding debts can help boost your creditworthiness over time. It’s also important to make all future payments on time and keep your credit utilization low.

Beyond financial considerations, it’s crucial to have a realistic understanding of your budget and what you can comfortably afford. This includes factoring in not only the mortgage payment but also other homeownership expenses like property taxes, insurance, and maintenance costs.

Remember, the journey to homeownership may require patience and perseverance, but every step you take towards improving your credit and managing your finances responsibly brings you closer to realizing your goal of owning a home. Stay determined, seek guidance from professionals, and remain focused on your long-term vision. With the right mindset and proactive approach, you can overcome the challenges and make your dream of homeownership a reality.

Reed Letson

Reed offers two decades of expertise as a mortgage broker, focusing on veterans and first-time home buyers. With a strong grasp of real estate and mortgage markets, he empowers clients with practical insights. Reed's passion is guiding clients to build wealth through real estate investments and financing solutions.

Reed Letson

Reed offers two decades of expertise as a mortgage broker, focusing on veterans and first-time home buyers. With a strong grasp of real estate and mortgage markets, he empowers clients with practical insights. Reed’s passion is guiding clients to build wealth through real estate investments and financing solutions.